Early in April 2019, the Task Force for Fiscal Policy for Health published their report ‘Health Taxes to Save Lives.’ This report explores the effect of taxing tobacco, alcohol and sugar-sweetened beverages (SSBs) on the purchase and consumption of these products.

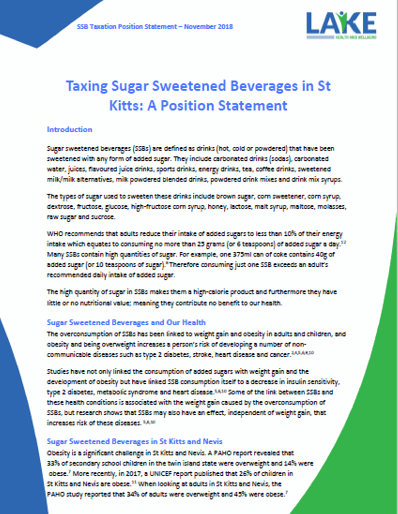

These products are the focus of this report because they contribute significantly to increasing a person’s risk of developing a non-communicable disease (NCD).

They explain that the introduction of well-designed excise taxes can significantly reduce the consumption of tobacco, alcohol and SSBs and as a result improve the public’s health, save lives and raise a significant amount of revenue that can be used to tackle NCDs.

In order to reap the benefits of taxing these products, the Task Force recommends that the imposed tax should be an excise tax (as opposed to a sales tax or increasing customs duty) and the level of tax should be high enough to deter consumption from those in both high and low-income brackets.

“If all countries increased their excise taxes to raise prices on tobacco, alcohol, and sugary beverages by 50 per cent, over 50 million premature deaths could be averted worldwide over the next 50 years while raising over the US $20 trillion of additional revenues in present discounted value. Raising taxes and prices further in future years would save additional lives and raise even more revenues.”

The report stresses the importance of the taxation of these three products as a strategy for tackling NCDs as data has shown that 10 million premature deaths per year could be prevented by reducing the public’s consumption of tobacco, alcohol and SSBs.

The report also addresses industry’s opposition to taxation, which the Task Force describes as “flawed” and they further state that industry’s arguments against taxation are “false or greatly exaggerated, and none justify inaction.”

In the report, the Task Force takes each of industry’s arguments and addresses them showing why they are flawed, false or exaggerated. Industry’s arguments include:

- A decline in government revenue

- Loss of employment

- A negative impact on the poor

- Illicit trade, tax avoidance, and tax evasion

They also explain how industry has tried to influence and undermine public policy in unethical ways to halt the progress of taxation. Industry has sought to confuse the public, censor scientific research on the harms of their products and have used other such tactics to disrupt work by public health officials and policy workers.

The report concludes with a call for countries to take urgent action to reduce the consumption of tobacco, alcohol and SSBs. The Task Force, at the end of its report, recommends the following:

- Countries should rapidly and significantly increase tobacco taxes and continue to raise taxes over time to make tobacco products less affordable, to reduce use, and to prevent unnecessary death and disease.

- Countries should rapidly and significantly increase alcohol taxes and continue to raise taxes over time to make alcohol less affordable, to reduce consumption, and to prevent unnecessary death and disease.

- Countries should actively implement policies directed at reducing consumption of sugar as it is a significant contributor to the rise in obesity, diabetes, and other associated noncommunicable diseases.

- Countries should design their health taxes to be easy to administer, hard to manipulate, and difficult to game.

- In addition to significantly raising health taxes in the short term, countries should improve excise tax administration and enforcement in order to reap the full benefits for health and revenues.

- The international community – including international financial institutions and UN agencies, governments, civil society, and the research community – should take action to support countries to adopt, implement, and significantly raise effective health taxes.

You can download the full below.