Last week, the UK’s Chancellor, Philip Hammond, published the UK’s 2017 Spring Budget and there were a few decisions made that will affect the public’s health and wellbeing. These decisions focus on the following areas:

- Alcohol

- Tobacco

- Soft drinks

- Access to new drugs and treatments

- Health and social care services

- Women’s Health (through the tampon tax fund)

Alcohol

From 13 March 2017, the duty rates on beer, cider, wine and spirits were increased in line with RPI inflation. This was not well-received by the hospitality industry who were hoping for a freeze or cut of the previously announced increases. But the government’s health impact assessment suggests that the increases are likely to lead to a minor decrease in overall alcohol consumption in the UK. From a public health point of view, this is promising news as excessive alcohol consumption is linked to an increased risk of developing a number of diseases including mouth, throat, breast and live cancers, heart disease, stroke and liver disease so any decrease in alcohol consumption is of benefit to the health of the nation.

Tobacco

From 8th March 2017, duty rates on all tobacco products increased by 2% above RPI inflation and the government will introduce a Minimum Excise Tax for cigarettes. This will target the cheapest tobacco and raise funds for the government. This policy aims to stop the public, particularly young people, from purchasing cheap cigarettes with data showing that 71% of 16-24 year olds who smoke buy the cheaper brands. By making these products unaffordable it is hoped that it will prevent young people from taking up the habit of smoking or stop those who already smoke. With smoking being strongly linked to lung cancer any strategy that reduces the amount of people who smoke will go some way to reducing lung cancer rates as well as the other diseases linked to smoking such as chronic obstructive pulmonary disease, heart disease, stroke and more.

Soft Drinks Levy

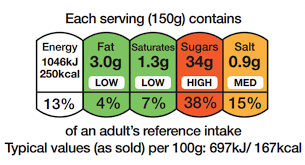

The soft drinks levy was announced in previous budgets and in this budget the Chancellor confirmed the detail of what the levies would be. The rate for drinks with a total sugar content of 5 grams or more per 100 millilitres will be set at 18 pence per litre and those with 8 grams or more per 100 millilitres will be set at 24 pence per litre. It is expected that this will raise an extra £1Bn and will come into effect from April 2018.

The money raised from the sugar levy will be used to double the funding available to primary schools for PE and sports programmes. The government has estimated the sugar levy will raise £320 million a year for primary schools to support healthier more active lifestyles in children. The funding will not only go towards expanding PE and sports programmes but to also expand breakfast clubs in primary schools ensuring that children have access to a healthy breakfast every week day.

The idea behind the sugar levy is a good one. It’s hoped that the levy will incentivise the soft drinks industry to reduce the amount of sugar in their products, helping the public consume less sugar. The money raised will go towards helping children get more active and healthy and thus tackle our high rates of childhood obesity. So, from a public health point of view the sugar levy is a win-win.

Access to new drugs and treatments

The Industrial Strategy Challenge Fund (ISCF) will support collaboration between business and the science community. There will be an initial investment of £270 million in 2017-18 to kick-start the development technologies that have the potential to transform the UK economy. The first wave of funding will focus on a number of areas, one of which will be improving and accelerating patient access to new drugs and treatments by exploring ways of improving manufacturing technologies. This is a much-needed area of focus for patients ensuring that they have access to the best treatments, but it is important to ensure that these drugs and treatments are affordable to ensure that all patients benefit.

Health and Social Care Services

An additional £2 billion will be provided to local government over the next three years to support adult social care services. Half of this funding will be made available in the 2017/2018 financial year so that councils across the UK can take immediate action to support local social care providers and relieve the pressure on the NHS locally. This a significant amount of funding and we hope that a clear strategy for social care is developed and implemented so that a real difference is made.

The government will also provide an additional £100 million to the NHS in England in 2017-18 to improve waiting times and manage the increasing demands on A&E departments. There was mention in the budget of “increase the provision of on-site GP facilities” in A&E and we feel with the increasing pressures that GPs are under coupled with the shortage of GPs, moving them into an A&E setting may not be the best approach to tackling the challenges in A&E.

The government will continue its work supporting Sustainability and Transformational Plans in the NHS and will invest £325 million over the next three years to support local proposals that aim to improve patient care in a sustainable way.

Support Women’s Health and Wellbeing Through the Tampon Tax

Tampons are considered a luxury item and therefore have to be taxed, but following a campaign to cut the tampon tax the government decided, in a previous budget, that every year £15M raised from the tampon tax will be given to women’s charities. In this current budget the Chancellor has agreed to continue this.

The tampon tax has made a significant difference to women’s health with charities like Ovarian Cancer Action, Jo’s Cervical Cancer Trust, The Eve Appeal and Breast Cancer Care benefiting from the funding. We hope that this funding will continue and that charities focusing on health issues that are of particular concern to black women will apply.

Our Conclusion

The government has introduced some policies and allocated funding to areas that will make a difference to the health of UK’s public. We do believe that opportunities were missed to really support disease prevention by going further with measures to reduce obesity and there was only an indirect focus on physical activity through the use of the funding for the sugar tax.

For the black community to benefit from this budget we encourage black charities working on women’s issues to explore the tampon tax funding and put in an application when the next funding round opens. We also encourage the black community to engage with their local councils and get involved in any consultations regarding the use of the money allocated to them for social care services.