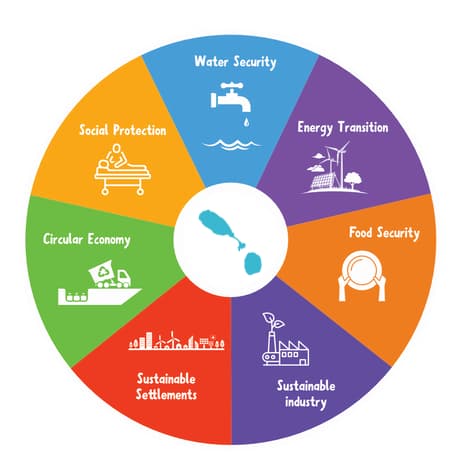

St. Kitts and Nevis, being a Small Island Developing State (SIDS), faces specific challenges that threaten its financial and environmental sustainability. This includes its small size, remoteness, and significant dependence on imports. Additionally, SIDS, like St Kitts and Nevis, are disproportionately affected by the negative effects of climate change and natural disasters. All these factors make St. Kitts and Nevis particularly vulnerable as we begin to experience, more acutely, the effects of climate change. Natural disasters are becoming more common and severe, and periods of global conflict and scarcity further exacerbate these vulnerabilities. This means that the long-term viability and development of our country is at risk. To address these vulnerabilities, the government of St. Kitts and Nevis is transitioning to a sustainable island state through its new Sustainable Island State Agenda. This agenda focuses on seven key pillars as summarised in the diagram on the right.

The Importance of Health for Our Sustainability

Health plays a crucial role in SIDS’s sustainability because any country’s development and resilience are tied to its human capital. Healthy people are more resilient to environmental shocks, including natural disasters and climate change, and a robust health system supports this resilience by providing quality care and ensures a timely response during emergencies, thereby reducing vulnerabilities. Additionally, healthy people can fully participate in society and thus actively contribute to sustainable development.

Non-Communicable Diseases (NCDs) Are A Major Threat to our Sustainability

To tackle NCDs, the World Health Organisation (WHO), Pan American Health Organisation (PAHO), the Caribbean Public Health Agency (CARPHA) and the NCD Alliance recommend that countries implement a collection of policies referred to as the ‘NCD Best Buys’ and ‘NCD Good Buys.’ These are evidence-based cost-effective policies that have been proven to prevent and control NCDs. Currently, the Ministry of Health is pursuing several of these policies including a policy on sugar-sweetened beverage taxation, a policy that we are in support of and have been advocating for through our You’re Sweet Enough project.

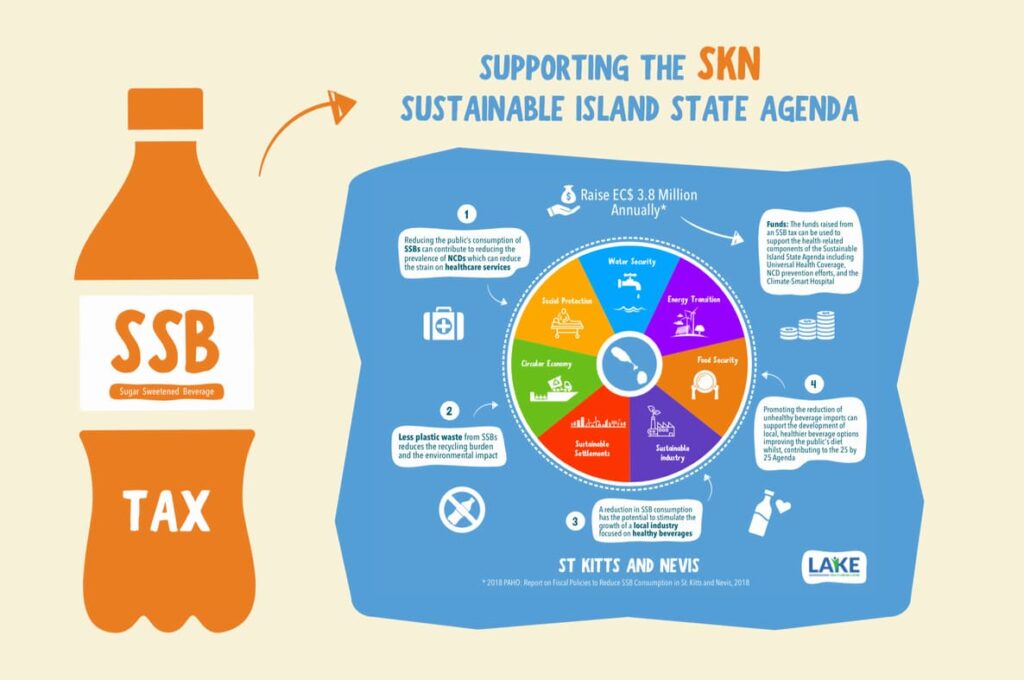

How SSB Taxation Can Support SKN’s Transition to a Sustainable Island State

SSB taxation can play a crucial role in supporting St. Kitts and Nevis’ transition to a sustainable island state by addressing four of the main pillars – social protection, circular economy, food security and sustainable industry. Ultimately, an effective tax design can improve the health of the public because it leads to a reduction in the consumption these products. By reducing the public’s SSB consumption, we can reduce a major source of added sugar in the public’s diet, and in turn, this can lead to weight loss and, therefore, a reduction of the public’s risk of developing NCDs, and as mentioned previously, a healthy public is essential for our transition to a sustainable island state.

As well as contributing to the prevention and control of NCDs, the reduction of the public’s consumption of SSBs can also lead to:

.

- A reduction in plastic waste: With the Caribbean Sea ranking as the 2nd most plastic-contaminated sea in the world, the need for policy intervention is evident[1]. SSBs contribute significantly to this contamination. The Ocean Conservancy’s 2022 international coastal clean-up report revealed that in St Kitts and Nevis, plastic beverage bottles were the top item collected during coastal clean-ups[2]. Therefore, a reduction in the consumption of SSBs means fewer plastic bottles and containers in circulation, resulting in less plastic waste entering our oceans and threatening the sustainability of our marine life and food supplies. Additionally, a reduction in plastic waste would ease waste management burdens.

- A reduction of exposure to microplastics: SSBs often come in plastic packaging that can break down into microplastics, which have adverse health and environmental effects.

- A reduction in imports of SSBs and the creation of a local market for healthy beverages: Efforts to reduce SSB consumption can create a market for and encourage the development of locally produced, low-sugar, and nutritious beverage alternatives. This can create more healthy options for the public leading to the public adopting healthier behaviours. Research globally has shown that SSB taxes do not cause job losses. Therefore, there is the opportunity to leverage a transition to healthier beverage options into a thriving and dynamic healthy beverage industry.

All the benefits of reducing SSB consumption through taxation support the following pillars of the Sustainable Island State Agenda:

- Social Protection: Reducing the prevalence of obesity and NCDs creates a healthier population and can reduce the strain on universal healthcare services, resulting in cost savings for the state.

- Circular Economy: Less plastic waste reduces the recycling burden and the environmental impact of plastic disposal.

- Food Security: Promoting the reduction of unhealthy beverage imports can support the development of local, healthier beverage options improving the public’s diet whilst, contributing to the 25 by 25 agenda which aims to reduce our food import bill by 25% by 2025.

- Sustainable Industry: A reduction in SSB consumption has the potential to stimulate the growth of a local industry focused on healthy snacks and beverages, contributing to economic resilience and sustainability.

Funds from SSB Taxation Can Support the Sustainable Island State Agenda

Taxation of SSBs can generate revenue for the government. PAHO, in 2018 estimated that implementing an SSB tax of 20% could raise around EC$3.8 million annually which could be an additional, sustainable source of income that can contribute to improving the health of the nation. Specifically, this funding can be directed into supporting the costs of implementing health-related elements of the Sustainable Island State Agenda as follows:

- Social Protection: Funds can be used to support universal healthcare and the prevention and management of NCDs. Funds can also be used to promote health equity as the revenue can be utilised to support low-income and vulnerable communities in accessing healthier food options.

- Food Security and Supporting the Agricultural Sector’s 25 by 25 Agenda: Funds can be used for

- Subsidies for local fruits and vegetables: this will increase local fruit and vegetable production, reducing our dependence on imports whilst ensuring that healthy foods are more affordable and accessible.

- Creating a healthy school environment: Financing can be directed to developing a healthy school meals program, supporting local producers to supply healthy snacks and meals to schools and developing and supporting existing youth-led programs that focus on food security, such as school gardens that promote healthy eating and local agriculture.

- Developing a drinking water infrastructure: Funds can support the availability of clean drinking water in schools, government buildings, and public spaces as an alternative to SSBs

- Promoting breastfeeding as this provides complete food security for babies and infants while being a cost-effective, healthy, and environmentally friendly way to nourish them. Additionally, it reduces the risk of developing NCDs in both children and mothers. Funding can be used to expand and strengthen the Ministry of Health’s breastfeeding program with a focus on developing and implementing community and work-based breastfeeding programs and a federal breastfeeding policy. This includes ensuring working mothers have adequate paid maternity leave of at least 18 weeks, as recommended by UNICEF and WHO, to support and protect breastfeeding.

- Support for the new Climate-Smart Hospital: Tax revenue can support the construction and ongoing costs of the National Climate Smart Hospital, ensuring that healthcare facilities are resilient to climate impacts, operate sustainably and enable continuity of care during disasters.

- Sustainable Industry: Incentives can be provided to local entrepreneurs and small family businesses who embark on creating healthy snack and beverage businesses. This industry is growing, with entrepreneurs already creating locally inspired low-sugar beverages. Support from the income generated by the SSB tax may enable these businesses to grow and thrive. This industry can then not only cater to the local market but also has the potential for export, contributing to the economy’s diversification and resilience.

Conclusion

Through SSB taxation, St. Kitts and Nevis can make significant strides towards achieving its vision of a sustainable island state. This approach not only addresses immediate health concerns but also promotes long-term economic and environmental sustainability, aligning with the objectives of the Sustainable Island State Agenda.

More Information

For more information and background, you can read our paper here or by clicking on the image below

References

- WHO – https://www.who.int/news-room/fact-sheets/detail/noncommunicable-diseases

- Ministry of Health

- St. Kitts Ministry of Health Health Information Unit. Non-Communicable Disease Data Report. (2023).

- 1UN Environment Programme. (2019). Report on the Status of Styrofoam and Plastic Bag Bans in the Wider Caribbean | The Caribbean Environment Programme (CEP). [online] Available at: https://www.unep.org/cep/resources/report/report-status-styrofoam-and-plastic-bag-bans-wider-caribbean.

- Ocean Conservancy. (2023). Sea the Change. Available at: https://oceanconservancy.org/wp-content/uploads/2021/09/Annual-Report_FINAL_Digital.pdf.

- PAHO: Report on Fiscal Policies to Reduce SSB Consumption in St. Kitts and Nevis, 2018