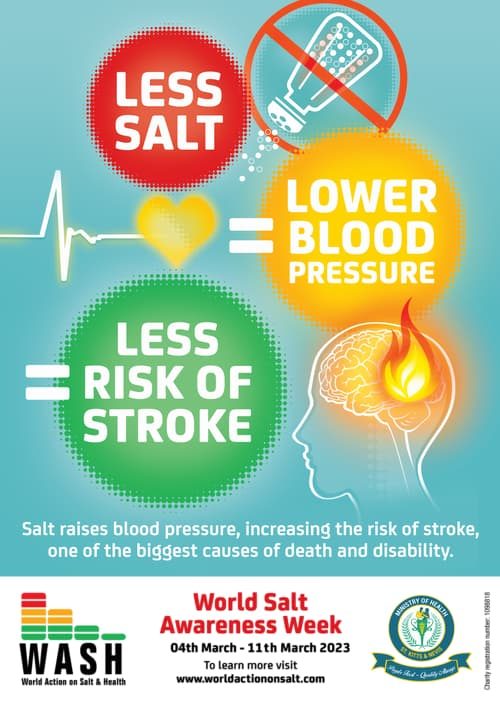

Salt Awareness Week

Salt Awareness Week is an annual event held every March to raise awareness about the dangers of consuming too much salt and the importance of reducing our salt intake. This year, Salt Awareness Week takes place from March 4th to March 11th.

Excessive salt consumption is a significant public health issue that is linked to a range of health problems such as high blood pressure, heart disease, stroke, and kidney disease. These non-communicable diseases (NCDs) are a growing concern in many countries worldwide, including St. Kitts and Nevis.

The World Health Organization recommends that adults should consume no more than 5 grams (about one teaspoon) of salt per day. However, the average person consumes much more than this amount, often without realizing it. Many processed and packaged foods, as well as restaurant meals, contain high amounts of salt.

Reducing salt intake is crucial to maintaining good health and preventing NCDs. Here are some useful tips to help you reduce your salt consumption:

- Read food labels: Check the labels of packaged foods to find out how much salt they contain. Choose lower-salt options when possible.

- Cook from scratch: Cooking from scratch allows you to control the amount of salt you add to your meals. Try using herbs, spices, and citrus juice instead of salt to add flavour to your dishes.

- Limit processed and packaged foods: Processed and packaged foods tend to be high in salt. Try to limit your consumption of these foods, and choose fresh, whole foods instead.

- Eat more fruits and vegetables: Fruits and vegetables are naturally low in salt and high in nutrients. Aim to eat at least five servings of fruits and vegetables per day.

- Use salt substitutes: Salt substitutes such as potassium chloride can be used in place of salt to reduce your sodium intake. However, if you have kidney problems or are taking certain medications, talk to your doctor before using salt substitutes.

In addition to these tips, it’s essential to be aware of the salt content of restaurant meals. Many restaurant dishes, especially fast food, are high in salt. If you eat out frequently, try to choose lower-salt options, or ask for your food to be prepared without added salt.

During Salt Awareness Week, we’re reminded of the importance of reducing our salt intake to maintain good health and prevent NCDs. By making small changes to our diet and lifestyle, we can reduce our risk of developing these conditions and live healthier, happier lives.