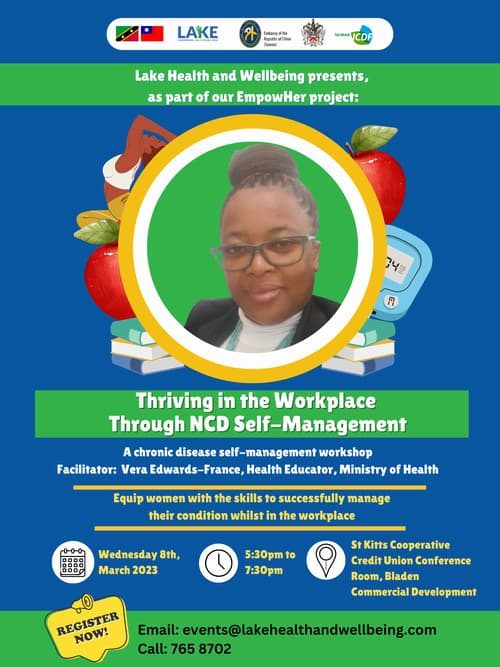

The EmpowHer series’ third workshop on “Thriving in the Workplace Through NCD Self-Management” was held on Wednesday, 8th March 2023, at the Conference Room of St Kitts Cooperative Credit Union. The training aimed to equip women living with non-communicable diseases (NCDs) with the necessary skills to manage their chronic health conditions while in the workplace.

The facilitator for the workshop was Vera Edwards-France, a health educator from the Ministry of Health. The training focused on four important self-management techniques: problem-solving, decision-making, physical activity, and action planning. The participants’ feedback on the workshop was gathered to determine what they found most useful, any areas for improvement, the specific skills they learned and plan to use, and their overall confidence in managing their condition while working.

Participants who attended the workshop said they were ‘very satisfied’ or ‘satisfied’ with the workshop. In terms of what participants found most helpful, the responses varied. However, the decision-making process and steps to achieving personal success, as well as the information on physical activity, diet, and lifestyle changes, were highlighted. Some participants appreciated the discussion of issues with other participants and the use of humour during the workshop.

Almost all participants said they were ‘very likely’ or ‘likely’ to use the skills they learned from the workshop and the skills they plan to use varied, but most expressed an interest in making changes to their diet and lifestyle, implementing their action plan, and speaking with their boss about their health.

Participants stated they felt more confident or somewhat confident about managing their chronic health conditions in the workplace as a result of this workshop.

Additional feedback and suggestions included praise for Ms Edwards-France for her flexibility and allowing individuals to share and for her informative and enjoyable presentation skills. One participant expressed an interest in learning more about the chronic disease self-management programme, and another mentioned using the information for preventative care. Finally, a participant with polycystic ovary syndrome (PCOS) found the information helpful and plans to use it for their journey’s success.

Overall, the Thriving in the Workplace Through NCD Self-Management workshop appears to have been helpful for participants, with the majority expressing high levels of satisfaction and the likelihood of using the skills learned. The information provided was found to be appropriate and informative, and the facilitator’s knowledge and presentation skills were praised.

The workshop’s importance cannot be overstated, especially for women living with NCDs who need to manage their condition while working. According to Stanford University, chronic disease self-management is an essential part of addressing the increasing prevalence of chronic diseases globally. Research has shown that people who take an active role in their care and learn self-management skills experience improved quality of life, fewer hospitalizations, and lower healthcare costs.

The workplace can be a challenging environment for individuals living with NCDs. They may experience fatigue, pain, and other symptoms that can affect their productivity and ability to work. By equipping women with self-management skills, they can take an active role in managing their condition, make informed decisions and advocate for their needs in the workplace. This can lead to improved health outcomes and overall well-being.

Additionally, providing support for individuals living with NCDs can have a positive impact on the workplace as a whole. Employers who provide accommodations and support for their employees with NCDs can see increased productivity, decreased absenteeism, and improved employee morale. This, in turn, can lead to a more positive and inclusive workplace culture.

It is essential that we continue to prioritize and invest in programs that provide education and support for individuals living with NCDs, particularly women who may face unique challenges in the workplace. By doing so, we can promote health equity and ensure that everyone has the opportunity to reach their full potential both in their personal and professional lives.